Last night, my wife asked me to check out a company called “Salesforce.com” which specializes in CRM applications. She thinks it is a good company because, apparently, it takes up a lot of market shares from CRM giant Siebel and product-wise, its flagship CRM application is supposed to be one of the best in the industry. A friend of hers who is working with “Salesforce.com” has the same opinion, opinions from ‘horse’s mouth’ should be quite credible.

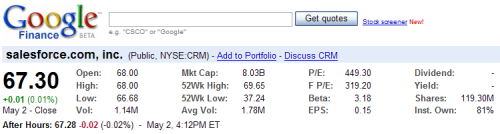

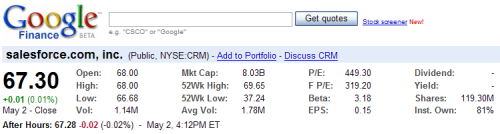

Good products, good market shares, but is the stock good to buy too? I quickly checked it out at Google Finance: http://finance.google.com/finance?q=NYSE%3ACRM

The number that first got my attention was the P/E ratio: 449.30.

In 1 sentence, it simply means that the market is willing to pay about 450 times for 1 dollar of earnings.

My impulsive reaction at that moment was as follows:

The Benjamin Graham in me immediately told me that ‘don’t bother to look into it, P/E ratio with anything >20 is considered high and hence overpriced. my strategy is always look at under-valued stocks and stocks with low P/E ratio.’

The William O’Neal in me said the opposite, ‘it is naive to base on P/E ratio alone to judge if it is overpriced! A lot of growth stocks in the past had large P/E ratios before they hit prices of more than 300% or even 3000% increase!’

Whatever conclusion, if any, came out of this impulsive reaction is definitely immature. So, let’s take a step back to understand the definition first and discuss further.

Definition

EPS = Earnings Per Share

Price to Earnings or P/E ratio = Market price/EPS

Earnings per share measures the returns to the common stockholders for every share invested. It is calculated by dividing bottom-line net income less any dividends paid to the preferred stockholders by the number of ordinary or common shares. Generally, when comparing two companies in the same industry and market, the one with higher EPS is more attractive as it is more profitable.

P/E ratio is basically the number of times the stocks of the company are selling in terms of the amount of earnings per share. Or from another angle, it is how many times the market is willing to pay for 1 dollar of earnings of the company.

Benjamin Graham’s value investing

I am not going to cover all aspects in value investing here, I just like to zoom into the P/E ratio’s aspect of it. In Graham’s “The Intelligent Investor” and Hagstrom’s “The Warren Buffet Way”, two Graham’s ‘basic’ approaches in common stock selection are mentioned, they, when applied, adhere to the ‘margin of safety’. The first approach is buying a company for less than two-thirds of its net asset value. The second approach is focusing on low P/E ratio stocks. Additionally the company must have some net asset value. In other words, the company must owe less than it is worth. Basically, we are looking into stocks selling at a discount to their intrinsic values and those companies which have below-average earnings now and therefore low P/E ratio – but will definitely have a positive and higher expected earnings in the future because of their overall good fundamentals.

William O’Neal’s focus on growth stocks

In O’Neal’s “How to make money in stocks”, his CanSlim methodology focuses on identifying ‘growth stocks’ which usually have high P/E ratios. Growth stocks would typically sell at high P/E ratios compared to the average stock, because of their expected higher earnings growth. Such companies had substantial growth in earnings in the past and because they have good fundamentals such as good products, the forecasted growth in earnings will correspondingly go up and so will the P/E ratio.

He criticises the common investors who blindly think stocks with high P/E ratios are overpriced. He quoted a few credible examples such as Xerox’s P/E ratio = 100 times in 1960 before it advanced 3300% in price; Syntex’s P/E ratio = 45 before price hike of 400% and so on to prove these people wrong.

My short and quick analysis

Compare across industry

What I wrote above on Graham’s and O’Neal’s school of thoughts are overly simplified. In their books, they cover a lot more on other aspects of company analysis which I will touch in my upcoming posts.

Back to the discussion of P/E ratio, there is no benchmark or standard for what P/E ratios should be. The P/E ratio should be compared with industry-wide and market-wide averages to judge whether it is too high or too low.

As such, I also did a quick Google on Oracle and SAP, their P/E ratios are: 22.11 and 20.93 respectively. Microsoft’s is 16.95 and IBM’s is 16.05. They all seem to have more ‘sensible’ P/E ratios as compared to Salesforce.com’s 450.

A hardcore O’Neal fan may still argue that we should look into it’s past earnings growth and do some time-trending analysis before we conclude if 450 is still high.

But this round, the Benjamin Graham in me won the battle, I would not bother to continue look into this company as it’s P/E ratio has already failed my first pass of stock selections. It’s way over-priced and the number 450 is way too ridiculous after comparing Salesforce.com with other software companies in the same industry and market. There is literally no ‘margin of safety’.

Sorry wifey, I give this stock a pass, even though it might be a potential growth stock, but I would rather spend my time analysing other more promising companies.

Understand under-valued stocks

One way to go deeper and understand why company with low P/E ratios are recommended as good buys is to first comprehend why the price of the shares has been under-valued by the market. In most cases, it is because the company has disappointing earnings recorded. As a result the average investor, who assumes that the poor performance of the company will continue, stays away from the stocks. But the truth is, such stocks are likely to have an above average growth in earnings in the future because of their good fundamentals. Consequently, as long as investors are misinformed about these stocks, the share prices wll remain to be undervalued. However, this state of ignorance will not last forever, very soon as more investors realise the good potential of the company, new demand for its shares is generated and investors wll chase the shares leading to a price rise. Well, on one hand, not all low P/E stocks are worthwhile investments, on the other hand, they are good buys if the performance of the company is expected to improve.

High P/E stocks go well in bull markets only?

To be fair to O’Neal, he is not really hard-core about sticking to high P/E ratios. His main point is that as quoted in his book: ‘P/E is an end effect, not a cause. Primary consideration should be given to whether the rate of change in earnings is substantially increasing or decreasing.’ But he maintains the stand that growth stocks usually have high P/E ratio and during his stock selection process, he watches out for stocks with high P/E ratio in bull market.

Another way O’Neal uses P/E ratios is to estimate the potential price objective for a growth stock over the next 6 to 18 months based on its estimated future earnings. He takes the earnings estimate for the next two years and multiply it by the stock’s P/E ratio at the initial chart base buy point multipled by 130%. However, he emphasised, again, this works only in bull market.

If you read his book carefully, he repeatedly reminded us to avoid high P/E bias during bull markets. While I cannot conclude that high P/E stocks go well only in bull markets, I am sure we definitely need to take market condition into consideration while picking high P/E stocks. That’s another reason why I would not take a second look at salesforce.com as it’s stock price has been trading ‘sideways’, not a clear-cut uptrend.

Common ground

While there are obvious differences between Graham’s and O’Neal schools of thoughts, one obvious thing O’Neal has in common with Graham is the importance of analysing the fundamentals of the company such as products, management, room to grow in terms of market share, etc. Would Graham blindly choose a company with low P/E ratio? Would Graham blindly select a second rate stock just because it was cheap? No, not without understanding the fundamentals and potential expected growth in the future and ensuring low P/E is not due to most ghastly earnings records.

Benjamin Graham actually did admit that focusing on low P/E and well below average price may ‘miss out company like Chrysler’ with high P/E ratio during bull run. So, in a way, he did acknowledge O’Neal’s approach but of course, he also subtly implied that his investment strategy could afford him to miss out potential opportunities in high P/E ratio stocks.

Wrap-up

There is no conclusion in this post. I would just like to use this post as a starting point to go deeper into the topic of fundamental analysis in the near future. P/E ratio was chosen as the ‘opening’ topic because this ratio is almost the most commonly mentioned number in any investment books, financial magazines and newspapers. Despite the fact that it’s the most ‘hyped’ ratio, not many people especially new investors know how to interpret it. Hope this little article help open up a bigger door to fundamental analysis.

References

1. The intelligent investors by Benjamin Graham

2. How to make money in stocks by WIlliam O’Neal

3. Handbook for stock investors by KC Goh

Postscript:

There seems to be a bug in Google site, if we divide market price by EPS, it should be 67.3/0.15=448.67, which is marginally smaller than what is published. We are not going to be nitpicky about this as this would not affect our discussion here.